38+ calculate mortgage interest deduction

Web The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Latitude 38 September 2005 By Latitude 38 Media Llc Issuu

Please note that if.

. Publication 936 explains the general rules for. Homeowners who bought houses before. Itemizing only makes sense if your itemized deductions total more than the standard deduction.

Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms. So the total Interest that is 1000000 5. X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured.

Web Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage debt up to 750000 on. Lock Your Rate Today. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a.

For tax year 2022 those amounts are rising to. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to. Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly.

Comparisons Trusted by 55000000. 750000 if the loan was finalized after Dec. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web Most homeowners can deduct all of their mortgage interest. Also you can deduct the points. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. However higher limitations 1 million 500000 if married.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. Web To take the mortgage interest deduction youll need to itemize.

Estimate your monthly mortgage payment. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. If you are single or married and.

Web Calculate Interest payment as shown below. Ad Calculate Your Payment with 0 Down. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

10 Best Home Loan Lenders Compared Reviewed. Web 11 hours agoIf your mortgage is 100000 and you have a 30-year fixed-rate mortgage with the current rate of 716 you will pay about 676 per month in principal and. Ad See how much house you can afford.

Veterans Use This Powerful VA Loan Benefit for Your Next Home. Ad Get Instantly Matched With Your Ideal Mortgage Lender.

Mortgage Tax Deduction Calculator Navy Federal Credit Union

Home Mortgage Interest Deduction Calculator

Finance Ibcanada Group

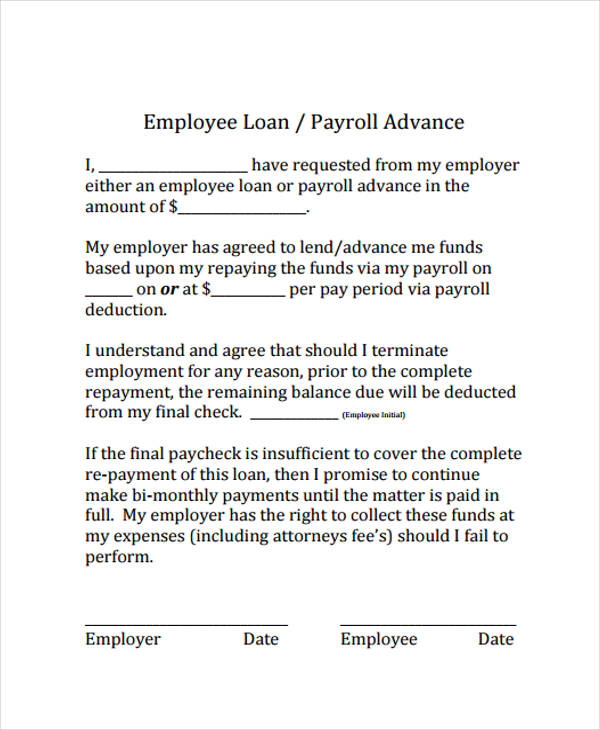

Free 65 Loan Agreement Form Example In Pdf Ms Word

Home Mortgage Loan Interest Payments Points Deduction

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Mortgage Interest Deduction How It Calculate Tax Savings

Is The Interest On Your Mortgage Tax Deductible In Canada Loans Canada

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

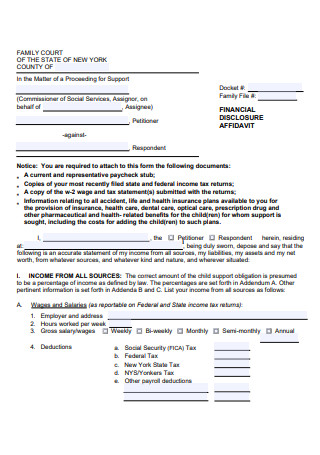

38 Sample Financial Affidavit In Pdf Ms Word

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

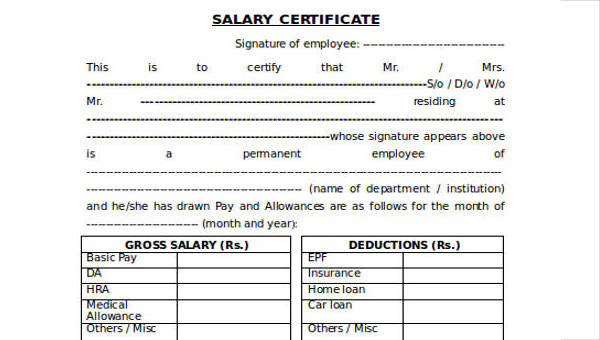

Free 38 Certificate Forms In Ms Word

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Race And Housing Series Mortgage Interest Deduction

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Calculate Your Mortgage Interest Deduction The Right Way Deduction Mortgage Interest Mortgage Loan Property Tax

Pdf Impacts Of The Job Retention And Rehabilitation Pilot Lucy Natarajan Academia Edu